With a thriving economy and a population well over 1 billion, China’s Online Travel Agency market is unsurprisingly one of the largest in the world. But just how big is the Chinese OTA market and where should businesses look for the best return on their marketing investment given a blossoming travel industry? Let’s take a look.

Background

China has led the world’s tourism market for close to a decade. The Chinese OTA market was valued at $44.7 billion in 2018, only behind the United States at $77.1 billion. However, the Chinese travel industry is both complex and nuanced, unlike prevails in other countries, and it’s not hard to see why. While a few giants lead the tourism industry, there’s no monopoly of any sort, thus giving rise to a dynamic travel ecosystem and ensuring that consumers have plenty of options when planning their itinerary.

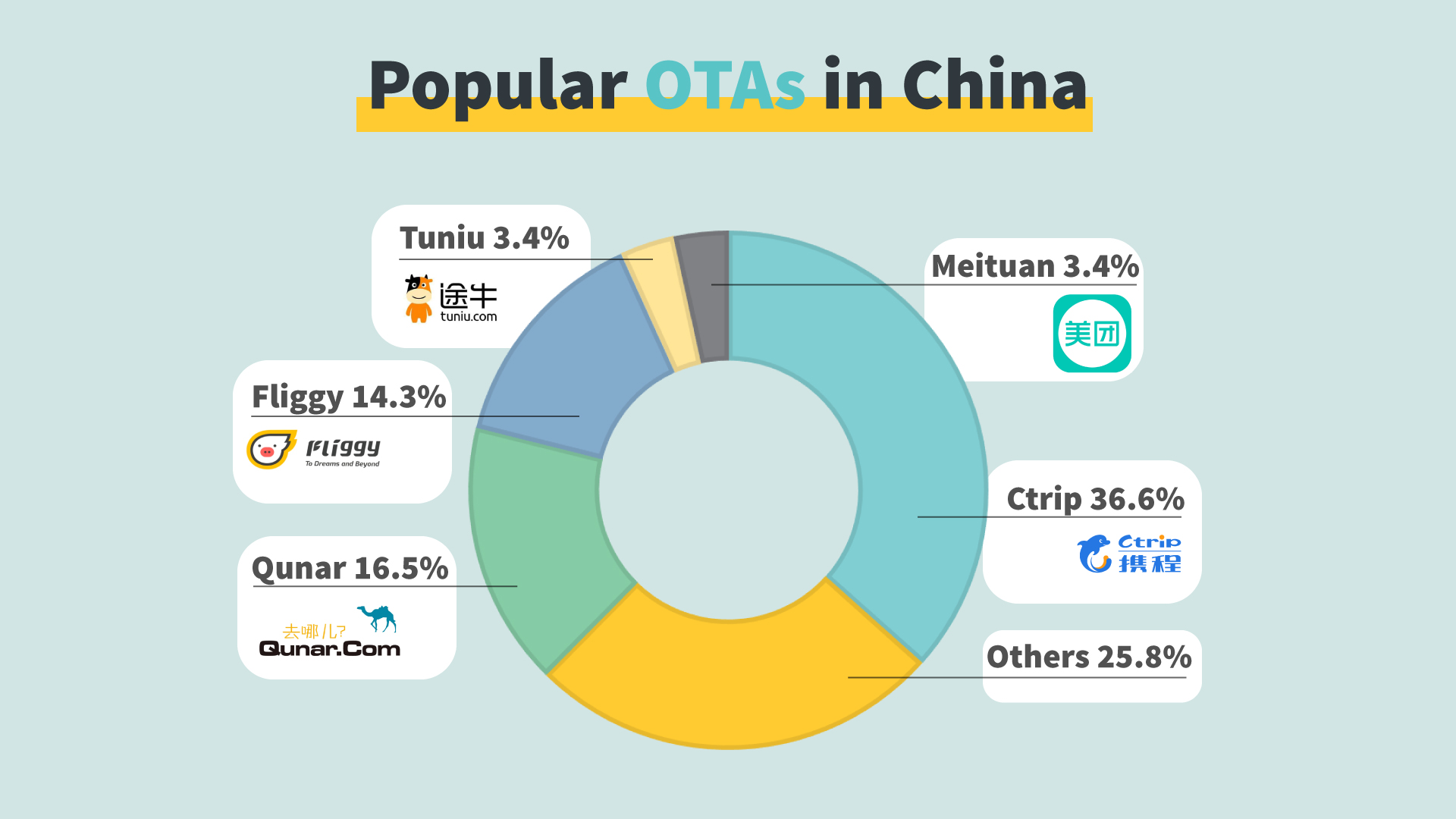

Sure, Ctrip easily dominates the Chinese OTA market, but there’s no shortage of competitors fighting for the travel pie. A ctcnn.com data shows that Ctrip enjoyed over 24% of the market share in 2014, with Tuniu in second at 11.7%, followed by Mafengwo at 3%. However, the “Other” category of small players drove more than 50% of the market. Citing strong competitors, and in a bid to expand its dominance, Ctrip soon acquired Qunar and eLong.

But things have since changed. In 2018, the OTA market was a mix of many players large and small. Ctrip’s competitors came from an unlikely industry, with Alibaba’s online travel marketplace Fliggy specifically leading the charge. Alibaba reworked Alitrip and Taoboa Travel into Fliggy, building a more formidable outfit that had since grown to become a key player in China’s OTA market. Fliggy’s rise has coincided with a shakeup in China’s OTA market structure. And while Ctrip remains popular, its competitor worries are not limited to Fliggy. Meituan Travel is another giant making a strong push to check Ctrip’s OTA popularity.

Today, a look at the Chinese OTA market shows a more robust blend of competitors, which has widened consumer options and opened more channels for tourism companies. In 2018, Ctrip led the OTA industry with 36.6% of the market share. Qunar was behind at 16.5%, closely followed by Fliggy’s 14.3%. Meituan and Tuniu each enjoyed 3.4%, with a fusion of other small players controlling 25.8% of the market share, down from more than 50% in 2014.

As competition heats up in the tourism industry, it’s also noteworthy that Ctrip’s dominance may not take a downward turn anytime soon, thanks to the company’s control of its closest competitor – Qunar. Still, the combined threat of Fliggy and Meituan, both well-funded outfits, cannot be ignored as the OTA market matures heading into the future.

OTA Trends in 2019

The OTA market in China is witnessing unprecedented gains, due in part to increasing consumer spend, more outbound trips and a growing number of businesses offering services to this exclusive group of high spending travellers. Fliggy and Meituan Travel are steadily gaining momentum, but Ctrip has successfully weathered the storm so far. With many tourist brands opening shop on Fliggy and the tourism market recording consistent gains, the Chinese OTA market is expected to mature even stronger in the coming years.

The Changing OTA landscape could see more entrants, further disrupting the market share and checking Ctrip’s dominance. This may particularly be important in the “other” group of OTA outfits comprising niche travel service providers. Ctrip has made efforts to stabilize growth and consolidate its position in the Chinese market and abroad. As part of expansion plans, Ctrip franchises in China are expected to number more than 8,000 by the end of 2019. No other Chinese OTA comes close. Ctrip also rebranded its mobile app as trip.com, a move that attracted more than 1 billion downloads. With the Ctrip app, travellers can make bookings and monitor flights on the go. The trip.com app is also available in English, Chinese, and seven other languages, which partly explains its massive popularity among travellers.

Conclusion

According to an estimate, Chinese tourists would be parting with more than $300 billion in tourism spend by 2020. As the growth of China’s OTA market parallels an increase in consumer spend, businesses are sure to profit from this huge market. This is especially true for tourism destinations in Asian countries, the top region for most Chinese outbound tourists. Businesses looking to tap into this big market would benefit from establishing a strong online presence. Thus, a well-thought online advertising strategy tailored to Chinese consumers will come in handy. While Ctrip continues to dominate the OTA market, new entrants and existing competitors are sure to provide the right challenge for a fluid tourism industry. Fliggy and Meituan Travel are especially strong contenders, and with many other OTAs focusing on growing niche traveling services, the future only looks brighter for the Chinese OTA landscape.